~CRUDEOIL futures drops by 0.72% : MCX records turnover of Rs.15739 crores in Commodity Futures & Rs.140093 crores in Options

Mumbai,Maharashtra, Jun 16, GOLD futures drops by 0.41%, while SILVER futures gains by 0.34% ,BULLDEX futures reaches at 23137 on MCX.

MCX sources said DAILY MARKET REPORT today, India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.155834.44 crores in various futures & option contracts for commodities listed at MCX on Monday, June 16, 2025 till 4:00 pm. In which commodity futures accounted for Rs. 15739.51 crores and options on commodity futures for Rs. 140093.19 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 23137.

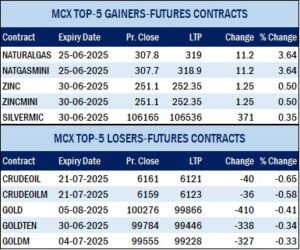

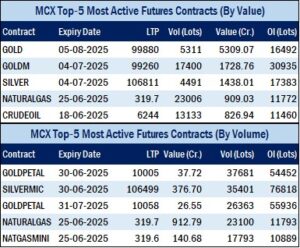

Commodity Future Contracts: Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 11506.50 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was down by Rs.410 or 0.41% to Rs. 99866 per 10 gram, GOLDTEN June-2025 contract was down by Rs.338 or 0.34% to Rs. 99446 per 10 gram, GOLDGUINEA June-2025 contract was down by Rs.86 or 0.11% to Rs. 79840 per 8 gram and GOLDPETAL June-2025 contract was up by Rs.2 or 0.02% to Rs. 10005 per gram. On other hand, GOLDM July-2025 contract was down by Rs.327 or 0.33% to Rs. 99228 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.357 or 0.34% to Rs. 106850 per kg, while SILVERM June-2025 contract was up by Rs.344 or 0.32% to Rs. 106555 per kg and SILVERMIC June-2025 contract was up by Rs.371 or 0.35% to Rs. 106536 per kg.

GOLD futures clocked turnover of Rs. 5624.71 crores with volume of 5623 lots and OI of 17644 lots while SILVER futures clocked turnover of Rs. 1696.68 crores with volume of 5289 lots and OI of 22713 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1400.49 crores. COPPER June-2025 contract was up by Rs.2.1 or 0.24% to Rs. 878 per kg and ZINC June-2025 contract was up by Rs.1.25 or 0.5% to Rs. 252.35 per kg while ALUMINIUM June-2025 contract was down by Rs.0.1 or 0.04% to Rs. 242 per kg and LEAD June-2025 contract was up by Rs.0.1 or 0.06% to Rs. 179.55 per kg.

COPPER futures clocked turnover of Rs. 909.15 crores, ALUMINIUM futures Rs. 99.09 crores, LEAD futures Rs. 18.61 crores, and ZINC futures clocked turnover of Rs. 280.35 crores.

Energy: Turnover of energy futures products contributed for Rs. 2688.58 crores. CRUDEOIL June-2025 contract was down by Rs.45 or 0.72% to Rs. 6240 per BBL while NATURALGAS June-2025 contract was up by Rs.11.2 or 3.64% to Rs. 319 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 1312.92 crores and NATURAL GAS futures Rs. 1042.46 crores.

AGRI: MENTHAOIL June-2025 contract was up by Rs.0.8 or 0.09% to Rs. 920 per kg .

Options on Commodity Future Contracts:

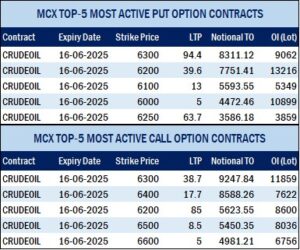

Commodity Options accounted for Rs. 140093.19 crores turnover (notional), having premium turnover of Rs. 1492.91 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option June contract at Strike price of Rs.6300 was down by Rs.108.3 or 74.13% to Rs. 37.80 with volume of 144167 lots & OI of 11700 lots, while CRUDE OIL Put Option June-2025 contract at Strike price of Rs.6300 was down by Rs.69.5 or 42.12% to Rs. 95.5 with volume of 129723 lots & OI of 9118 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option June contract at Strike price of Rs.320 was up by Rs.4.8 or 67.61% to Rs. 11.90 with volume of 18403 lots & OI of 10054 lots, while NATURAL GAS Put Option June-2025 contract at Strike price of Rs.310 was down by Rs.5.15 or 39.31% to Rs. 7.95 with volume of 13344 lots & OI of 5260 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.100000 was down by Rs.298.5 or 17.27% to Rs. 1430 with volume of 1116 lots & OI of 876 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.99000 was up by Rs.33 or 3.17% to Rs. 1075.5 with volume of 1501 lots & OI of 576 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.107000 was up by Rs.148.5 or 8.82% to Rs. 1832 with volume of 1356 lots & OI of 455 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.106000 was down by Rs.120 or 7.32% to Rs. 1519 with volume of 1397 lots & OI of 515 lots.