Mumbai, Maharashtra, Apr 18, GOLD futures drops by Rs.422 and SILVER futures drops by Rs.36, while CRUDEOIL futures drops by Rs.2 on MCX.

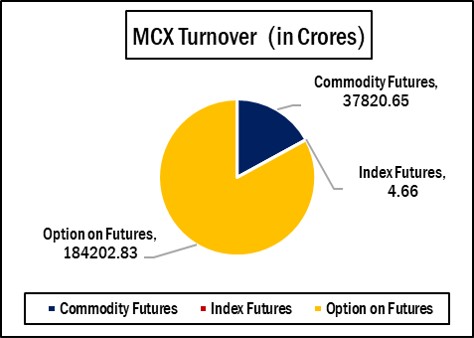

According to MCX DAILY MARKET REPORT today, Due to a public holiday on the occasion of Good Friday, trading in both sessions at the country’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX), remained closed. In Thursday’s session until 11:30 PM, a turnover of Rs.2,22,028.15 crore was recorded in various commodity futures, options, and index futures. Trading in commodity futures amounted to Rs.37,820.65 crore. A notional turnover of Rs.1,84,202.83 crore was recorded in commodity options. The Bullion Index Buldex April futures was at 21,891 points. The total premium turnover in commodity options was Rs.3,238.46 crore.

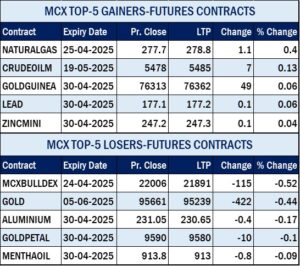

Commodity Future Contracts: Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 28751.62 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was down by Rs.422 or 0.44% to Rs. 95239 per 10 gram, GOLDTEN April-2025 contract was down by Rs.39 or 0.04% to Rs. 94961 per 10 gram, GOLDGUINEA April-2025 contract was up by Rs.49 or 0.06% to Rs. 76362 per 8 gram and GOLDPETAL April-2025 contract was down by Rs.10 or 0.1% to Rs. 9580 per gram. On other hand, GOLDM May-2025 contract was up by Rs.36 or 0.04% to Rs. 94820 per 10 gram.

SILVER futures, with May-2025 expiry contract was down by Rs.36 or 0.04% to Rs. 95001 per kg, while SILVERM April-2025 contract was down by Rs.63 or 0.07% to Rs. 94930 per kg and SILVERMIC April-2025 contract was down by Rs.56 or 0.06% to Rs. 94925 per kg.

GOLD futures clocked turnover of Rs. 13189.16 crores with volume of 13852 lots and OI of 23821 lots while SILVER futures clocked turnover of Rs. 4788.26 crores with volume of 16758 lots and OI of 22449 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 2913.44 crores. COPPER April-2025 contract was up by Rs.0.25 or 0.03% to Rs. 845.2 per kg and ZINC April-2025 contract was down by Rs.0.1 or 0.04% to Rs. 247.2 per kg while ALUMINIUM April-2025 contract was down by Rs.0.4 or 0.17% to Rs. 230.65 per kg and LEAD April-2025 contract was up by Rs.0.1 or 0.06% to Rs. 177.2 per kg.

COPPER futures clocked turnover of Rs. 1863.56 crores, ALUMINIUM futures Rs. 258.18 crores, LEAD futures Rs. 53.27 crores, and ZINC futures clocked turnover of Rs. 528.00 crores.

Energy: Turnover of energy futures products contributed for Rs. 6152.09 crores. CRUDEOIL April-2025 contract was down by Rs.2 or 0.04% to Rs. 5511 per BBL while NATURALGAS April-2025 contract was up by Rs.1.1 or 0.4% to Rs. 278.8 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 1422.03 crores and NATURAL GAS futures Rs. 3845.70 crores.

AGRI: MENTHAOIL April-2025 contract was down by Rs.0.8 or 0.09% to Rs. 913 per kg and COTTONCNDY May-2025 without any changes 55030 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 184202.83 crores turnover (notional), having premium turnover of Rs. 3238.46 crores.

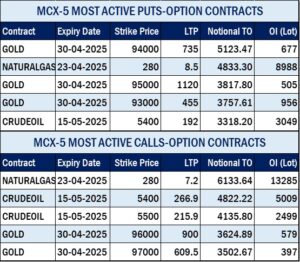

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option May-2025 contract at Strike price of Rs.5400 was up by Rs.0.4 or 0.15% to Rs. 266.90 with volume of 85728 lots & OI of 5009 lots, while CRUDE OIL Put Option May-2025 contract at Strike price of Rs.5400 was down by Rs.5.8 or 2.93% to Rs. 192 with volume of 58992 lots & OI of 3049 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option April-2025 contract at Strike price of Rs.280 was down by Rs.2 or 21.74% to Rs. 7.20 with volume of 169959 lots & OI of 13285 lots, while NATURAL GAS Put Option April-2025 contract at Strike price of Rs.280 was down by Rs.2.95 or 25.76% to Rs. 8.5 with volume of 133360 lots & OI of 8988 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.96000 was down by Rs.459 or 33.77% to Rs. 900 with volume of 3737 lots & OI of 579 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.94000 was down by Rs.81.5 or 9.98% to Rs. 735 with volume of 5399 lots & OI of 677 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option April-2025 contract at Strike price of Rs.96000 was down by Rs.31 or 3.73% to Rs. 799.5 with volume of 8645 lots & OI of 793 lots, while SILVER Put Option April-2025 contract at Strike price of Rs.95000 was down by Rs.14.5 or 1.27% to Rs. 1125.5 with volume of 7465 lots & OI of 898 lots.

GOLD futures drops by Rs.422 and SILVER futures drops by Rs.36, while CRUDEOIL futures drops by Rs.2 on MCX

On the occasion of Good Friday, trading in both sessions at MCX remained closed

Combined turnover in Thursday’s both sessions was Rs.37,820 crore in commodity futures and Rs.1,84,202 crore in commodity options

Trading in gold and silver futures amounted to Rs.28,751 crore

Bullion Index Buldex futures was at 21,891 points