~MCX records turnover of Rs.21701.71 crores in Commodity Futures & Rs.92003.67 crores in Options: MCXBULLDEX futures reaches at 22023

Mumbai, Maharashtra, May 22, GOLD futures drops by Rs.79 and SILVER futures by Rs.427: CRUDEOIL futures slips by Rs.68 on MCX.

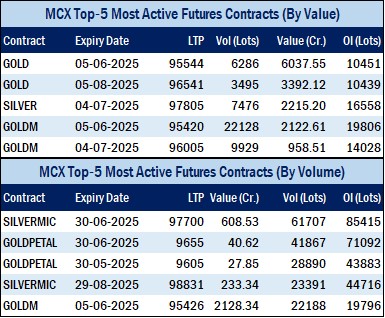

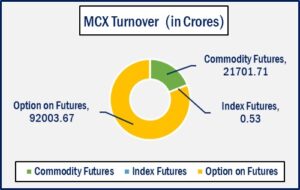

MCX sources said today DAILY MARKET REPORT India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.113705.91 crores in various futures & option contracts for commodities listed at MCX on Thursday, May 22, 2025 till 4:15 pm. In which commodity futures accounted for Rs. 21701.71 crores and options on commodity futures for Rs. 92003.67 crores (notional). Bullion Index MCXBULLDEX May-25 futures was reached at 22023.

Commodity Future Contracts: Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 17831.21 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was down by Rs.79 or 0.08% to Rs. 95520 per 10 gram, GOLDTEN May-2025 contract was up by Rs.62 or 0.06% to Rs. 95484 per 10 gram, GOLDGUINEA May-2025 contract was down by Rs.13 or 0.02% to Rs. 76627 per 8 gram and GOLDPETAL May-2025 contract was up by Rs.5 or 0.05% to Rs. 9605 per gram. On other hand, GOLDM June-2025 contract was down by Rs.47 or 0.05% to Rs. 95426 per 10 gram.

SILVER futures, with July expiry contract was down by Rs.427 or 0.43% to Rs. 97818 per kg, while SILVERM June-2025 contract was down by Rs.398 or 0.41% to Rs. 97700 per kg and SILVERMIC June-2025 contract was down by Rs.395 or 0.4% to Rs. 97700 per kg.

GOLD futures clocked turnover of Rs. 9601.51 crores with volume of 9957 lots and OI of 21152 lots while SILVER futures clocked turnover of Rs. 2589.98 crores with volume of 8724 lots and OI of 18224 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1502.19 crores. COPPER May-2025 contract was down by Rs.2.15 or 0.25% to Rs. 855.3 per kg and ZINC May-2025 contract was down by Rs.0.05 or 0.02% to Rs. 259.45 per kg while ALUMINIUM May-2025 contract was down by Rs.0.5 or 0.21% to Rs. 237.9 per kg and LEAD May-2025 contract was down by Rs.0.85 or 0.48% to Rs. 176.95 per kg.

COPPER futures clocked turnover of Rs. 1013.83 crores, ALUMINIUM futures Rs. 137.53 crores, LEAD futures Rs. 23.32 crores, and ZINC futures clocked turnover of Rs. 241.87 crores.

Energy: Turnover of energy futures products contributed for Rs. 1521.14 crores. CRUDEOIL June-2025 contract was down by Rs.68 or 1.28% to Rs. 5227 per BBL while NATURALGAS May-2025 contract was down by Rs.4.5 or 1.55% to Rs. 285.9 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 485.77 crores and NATURAL GAS futures Rs. 801.98 crores.

AGRI: MENTHAOIL May-2025 contract was down by Rs.0.2 or 0.02% to Rs. 909 per kg and COTTONCNDY May-2025 contract was up by Rs.280 or 0.52% to Rs. 54190 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 92003.67 crores turnover (notional), having premium turnover of Rs. 1119.52 crores.

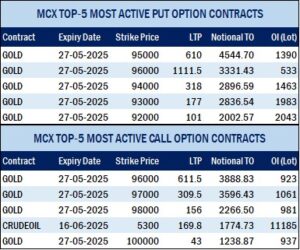

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option June contract at Strike price of Rs.5300 was down by Rs.19.8 or 10.24% to Rs. 173.50 with volume of 33107 lots & OI of 11299 lots, while CRUDE OIL Put Option June-2025 contract at Strike price of Rs.5200 was up by Rs.40.9 or 26.15% to Rs. 197.3 with volume of 35445 lots & OI of 8449 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option May contract at Strike price of Rs.290 was down by Rs.1.9 or 24.2% to Rs. 5.95 with volume of 34282 lots & OI of 9184 lots, while NATURAL GAS Put Option May-2025 contract at Strike price of Rs.285 was up by Rs.1.15 or 21.3% to Rs. 6.55 with volume of 24842 lots & OI of 5633 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option May-2025 contract at Strike price of Rs.96000 was down by Rs.65 or 9.25% to Rs. 638 with volume of 4114 lots & OI of 937 lots, while GOLD Put Option May-2025 contract at Strike price of Rs.95000 was down by Rs.48 or 7.45% to Rs. 596 with volume of 4898 lots & OI of 1404 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.100000 was down by Rs.280.5 or 12.3% to Rs. 2000 with volume of 683 lots & OI of 1199 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.98000 was up by Rs.251.5 or 9.06% to Rs. 3028 with volume of 467 lots & OI of 406 lots.