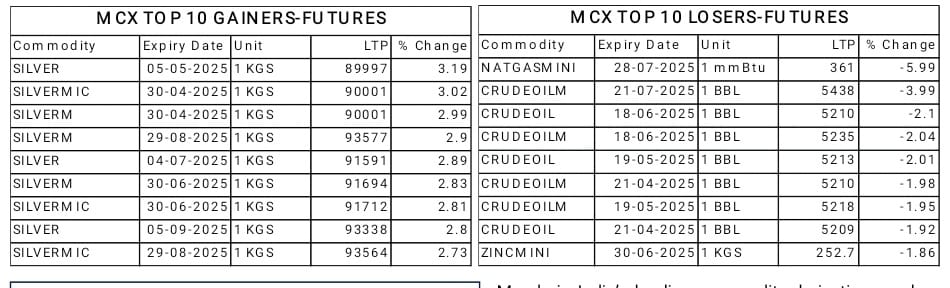

Mumbai, Maharashtra, Apr 07, Gold futures jumps by Rs. 655 and silver futures by Rs. 2,786, while Crude oil futures falls by Rs.102 on MCX.

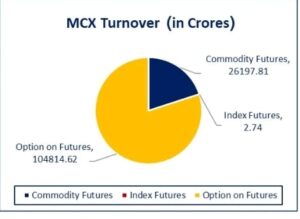

According to MCX DAILY MARKET REPORT today, India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.131015.17 crores in various futures & option contracts for commodities listed at MCX on Monday, April 07, 2025 till 5:00 pm. In which commodity futures accounted for Rs. 26197.81 crores and options on commodity futures for Rs. 104814.62 crores (notional). Bullion Index MCXBULLDEX Apr-25 futures was reached at 20465.

Commodity Future Contracts: Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 19941.76 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract was up by Rs.655 or 0.74% to Rs. 88730 per 10 gram, GOLDTEN April-2025 contract was up by Rs.396 or 0.45% to Rs. 88863 per 10 gram, GOLDGUINEA April-2025 contract was down by Rs.43 or 0.06% to Rs. 71526 per 8 gram and GOLDPETAL April-2025 contract was up by Rs.21 or 0.23% to Rs. 9009 per gram. On other hand, GOLDM May-2025 contract was up by Rs.585 or 0.67% to Rs. 88525 per 10 gram.

SILVER futures, with May-2025 expiry contract was up by Rs.2786 or 3.19% to Rs. 89997 per kg, while SILVERM April-2025 contract was up by Rs.2610 or 2.99% to Rs. 90001 per kg and SILVERMIC April-2025 contract was up by Rs.2638 or 3.02% to Rs. 90001 per kg.

GOLD futures clocked turnover of Rs. 6778.77 crores with volume of 7674 lots and OI of 17592 lots while SILVER futures clocked turnover of Rs. 6411.76 crores with volume of 24002 lots and OI of 28020 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 3466.19 crores. COPPER April-2025 contract was up by Rs.8.85 or 1.1% to Rs. 813.65 per kg and ZINC April-2025 contract was down by Rs.1.75 or 0.69% to Rs. 251.05 per kg while ALUMINIUM April-2025 contract was up by Rs.1.35 or 0.58% to Rs. 233.55 per kg and LEAD April-2025 contract was down by Rs.0.05 or 0.03% to Rs. 175.6 per kg.

COPPER futures clocked turnover of Rs. 2346.90 crores, ALUMINIUM futures Rs. 249.25 crores, LEAD futures Rs. 32.02 crores, and ZINC futures clocked turnover of Rs. 600.00 crores.

Energy: Turnover of energy futures products contributed for Rs. 2934.14 crores. CRUDEOIL April-2025 contract was down by Rs.102 or 1.92% to Rs. 5209 per BBL while NATURALGAS April-2025 contract was up by Rs.0.4 or 0.12% to Rs. 330.6 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 1501.87 crores and NATURAL GAS futures Rs. 1074.97 crores.

AGRI: MENTHAOIL April-2025 contract was up by Rs.2 or 0.22% to Rs. 914 per kg and COTTONCNDY May-2025 contract was up by Rs.460 or 0.84% to Rs. 54900 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 104814.62 crores turnover (notional), having premium turnover of Rs. 2344.88 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option April-2025 contract at Strike price of Rs.5200 was down by Rs.43.2 or 16.81% to Rs. 213.80 with volume of 69368 lots & OI of 7729 lots, while CRUDE OIL Put Option April-2025 contract at Strike price of Rs.5100 was up by Rs.41.3 or 36.04% to Rs. 155.9 with volume of 88342 lots & OI of 7007 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option April-2025 contract at Strike price of Rs.330 was up by Rs.0.95 or 5.57% to Rs. 18.00 with volume of 14431 lots & OI of 3936 lots, while NATURAL GAS Put Option April-2025 contract at Strike price of Rs.320 was up by Rs.0.7 or 5.69% to Rs. 13 with volume of 17127 lots & OI of 3860 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.90000 was up by Rs.310 or 47.11% to Rs. 968 with volume of 2259 lots & OI of 683 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.87000 was down by Rs.85 or 9.48% to Rs. 812 with volume of 1630 lots & OI of 694 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option April-2025 contract at Strike price of Rs.95000 was up by Rs.345 or 53.08% to Rs. 995 with volume of 1911 lots & OI of 1459 lots, while SILVER Put Option April-2025 contract at Strike price of Rs.88000 was down by Rs.1111.5 or 35.71% to Rs. 2001 with volume of 1549 lots & OI of 470 lots.