~GOLD futures gains by Rs.1626 or 1.68% and SILVER futures by Rs.488 or 0.46%, while CRUDEOIL futures drops by Rs.1 or 0.02% : MCXBULLDEX futures reaches at 22805

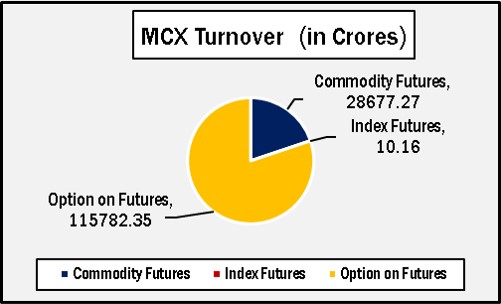

Mumbai, Maharashtra, Jun 12, MCX records turnover of Rs.28677.27 crores in Commodity Futures & Rs.115782.35 crores in Options.

MCX sources said today, DAILY MARKET REPORT, India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.144469.78 crores in various futures & option contracts for commodities listed at MCX on Thursday, June 12, 2025 till 4:30 pm. In which commodity futures accounted for Rs. 28677.27 crores and options on commodity futures for Rs. 115782.35 crores (notional). Bullion Index MCXBULLDEX Jun-25 futures was reached at 22805.

Commodity Future Contracts: Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 24353.64 crores. At the time of writing, MCX GOLD futures, with August-2025 expiry contract was up by Rs.1626 or 1.68% to Rs. 98330 per 10 gram, GOLDTEN June-2025 contract was up by Rs.1341 or 1.39% to Rs. 97870 per 10 gram, GOLDGUINEA June-2025 contract was up by Rs.898 or 1.16% to Rs. 78549 per 8 gram and GOLDPETAL June-2025 contract was up by Rs.105 or 1.08% to Rs. 9839 per gram. On other hand, GOLDM July-2025 contract was up by Rs.1453 or 1.51% to Rs. 97720 per 10 gram.

SILVER futures, with July expiry contract was up by Rs.488 or 0.46% to Rs. 105880 per kg, while SILVERM June-2025 contract was up by Rs.448 or 0.43% to Rs. 105633 per kg and SILVERMIC June-2025 contract was up by Rs.446 or 0.42% to Rs. 105620 per kg.

GOLD futures clocked turnover of Rs. 11374.08 crores with volume of 11609 lots and OI of 15459 lots while SILVER futures clocked turnover of Rs. 4223.87 crores with volume of 13358 lots and OI of 22631 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 1357.65 crores. COPPER June-2025 contract was up by Rs.2.7 or 0.31% to Rs. 874.1 per kg and ZINC June-2025 contract was down by Rs.0.5 or 0.2% to Rs. 252.15 per kg while ALUMINIUM June-2025 contract was down by Rs.0.25 or 0.1% to Rs. 242.1 per kg and LEAD June-2025 contract was up by Rs.0.15 or 0.08% to Rs. 179.25 per kg.

COPPER futures clocked turnover of Rs. 859.60 crores, ALUMINIUM futures Rs. 104.89 crores, LEAD futures Rs. 15.79 crores, and ZINC futures clocked turnover of Rs. 291.10 crores.

Energy: Turnover of energy futures products contributed for Rs. 2316.81 crores. CRUDEOIL June-2025 contract was down by Rs.1 or 0.02% to Rs. 5730 per BBL while NATURALGAS June-2025 contract was up by Rs.10.3 or 3.43% to Rs. 310.2 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 876.58 crores and NATURAL GAS futures Rs. 1130.99 crores.

AGRI: MENTHAOIL June-2025 contract was up by Rs.13.9 or 1.53% to Rs. 925 per kg and COTTONCNDY July-2025 was reached at 53150 per candy.

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 115782.35 crores turnover (notional), having premium turnover of Rs. 1491.35 crores.

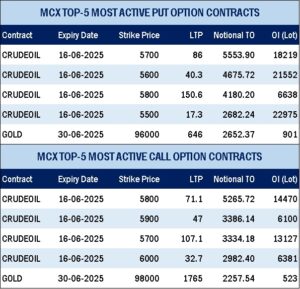

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option June contract at Strike price of Rs.5800 was up by Rs.12 or 19.48% to Rs. 73.60 with volume of 88226 lots & OI of 14510 lots, while CRUDE OIL Put Option June-2025 contract at Strike price of Rs.5700 was up by Rs.6.1 or 7.8% to Rs. 84.3 with volume of 94502 lots & OI of 18145 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option June contract at Strike price of Rs.310 was up by Rs.4.65 or 54.07% to Rs. 13.25 with volume of 19166 lots & OI of 6548 lots, while NATURAL GAS Put Option June-2025 contract at Strike price of Rs.300 was down by Rs.4.15 or 32.42% to Rs. 8.65 with volume of 18366 lots & OI of 8855 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option June-2025 contract at Strike price of Rs.98000 was up by Rs.827.5 or 89.7% to Rs. 1750 with volume of 2250 lots & OI of 530 lots, while GOLD Put Option June-2025 contract at Strike price of Rs.96000 was down by Rs.456 or 41.04% to Rs. 655 with volume of 2729 lots & OI of 895 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option June contract at Strike price of Rs.106000 was up by Rs.103 or 5.53% to Rs. 1965 with volume of 2427 lots & OI of 405 lots, while SILVER Put Option June-2025 contract at Strike price of Rs.105000 was down by Rs.246 or 13.09% to Rs. 1633.5 with volume of 2577 lots & OI of 672 lots.